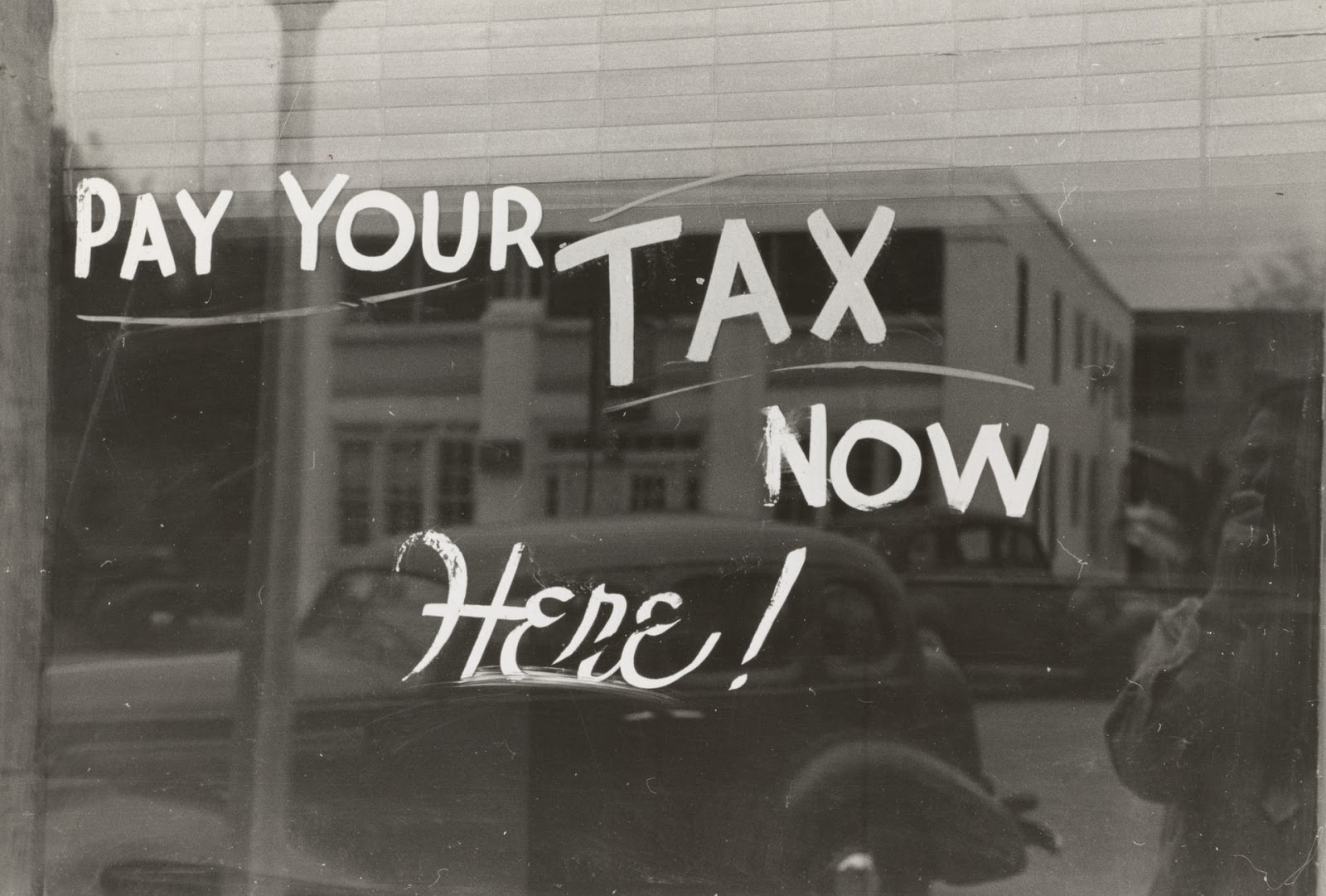

Photo by The New York Public Library on Unsplash

Even though the revenue service is very efficient at what they do, mistakes can happen.

After completing the audit of an individual’s taxation year, the CRA may alter the person’s income tax liability and might charge penalties and interest. After receiving a Notice of Assessment or Reassessment, issued by the Minister of National Revenue, you’re entitled to file an objection with the CRA Appeals.

This is to object to any changes made to your revenue responsibility and the assessment of fines and interest. While preparing a CRA Notice of Objection may seem like a straightforward process, there are various technical provisions that taxpayers should be aware of. Non-compliance with these requirements may strip you of your appeal rights.

Typical Rules

You’re entitled to object to a Notice of Assessment or Reassessment if:

- You disagree with the notification

- Your tax, penalty, or interest is assessed.

- You determine your filing position was incorrect

Photo by Kelly Sikkema on Unsplash

Content and Form

A Notice of Objection must be completed by hand. You can submit it as either a hand-written letter or by using the CRA’s T400A form. It must contain all of the relevant facts, explain your reasons for objecting to the reassessment, and either yourself or an authorized representative must sign it.

Large corporations (entities whose taxable capital exceeds C$10 million per year) must provide the following when filing a Notice of Objection:

- The entity has to explain each issue in question in detail

- They have to specify the sought after relief

- Each issue raised has to be backed by the facts and reasoning on which the entity relies

Time Limitations

Photo by Kelly Sikkema on Unsplash

According to subsection 165(1) of the Canadian Tax Act, you must serve your objection to the Minister:

- Within twelve months after your filing due date for the year

- Within 90 days after the Notice of Reassessment was sent

It’s possible to get a time extension at the discretion of the Minister. However, you must apply for this within twelve months after the deadline for serving an objection has expired. You must also prove that you did try to resolve the issue during the 90 days.

Where to Submit It and Who You Must Address

You can either mail your objection or submit it by hand to a Taxation Service Centre or the CRA’s district offices. Be sure to address it to the Chief of Appeals. You can also serve it using the CRA’s online services in ‘My Account’ or ‘My Business Account.’ Sending it to the wrong person or failing to deliver it to the proper place may invalidate it.

Although it’s no longer necessary to send your objection via registered mail, you must confirm receipt in writing from the CRA. If delivered by courier, an acknowledgment of delivery must be obtained from the company that you used.

“Scrabble Series Taxes” by ccPixs.com from Creative Commons

You’re Right to Object

Many of the processes within the revenue service are still completed manually. Therefore, mistakes are often made. If you believe that you’re paying too much tax or are being unfairly penalized, you’ve got the right to object to the CRA’s assessment.

An appeal may not result in you paying less or avoiding penalties and interest charges. However, it’ll ensure that your tax audit is reassessed, and any errors will be fixed.