Choosing a legal business structure for your small business is an essential part of the creation of your company and there are three key aspects that you need to take into account which will be explored below.

When starting your business, it’s important that you consider three main factors:

1. Profit and risk level

2. The importance of being considered investor-friendly

3. Would the ongoing effort of forming and maintaining a complicated business structure be worth not only the price, but also the work associated with it?

One of the most important things to consider is whether you require personal liability protection. Personal liability protection is when a business owner cannot be held personally liable for the debts of the business, nor runs into legal trouble. The owner’s personal assets (such as a car, house, or bank account) are safeguarded against being seized.

What are the different business structure types?

Essentially, there are two broad categories:

1. Informal Business Structures which do not provide personal liability protection. These include Sole Proprietorships and General Partnerships.

2. Formal Business Structures provide personal liability protection, and they include LLCs and Corporations.

Why choose a formal business structure?

There are many advantages to a formal business structure, including taxation advantages, improved credibility, and the most significant benefit of all, personal liability protection. There are two primary types of formal business structures:

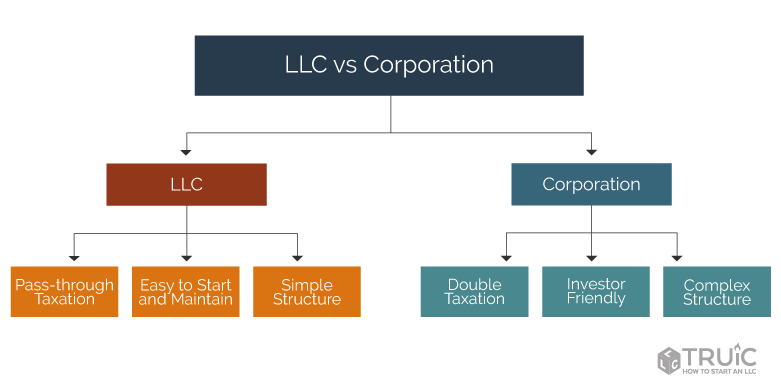

1. Limited Liability Company (LLC). An LLC is owned by its members and is the easiest way of structuring your business for the purpose of safeguarding your personal assets should the business fail or have to deal with legal troubles. LLCs also have the benefit of having unique tax advantages.

2. Corporation. A corporation is owned by shareholders and while it also provides personal liability protection, it is more complicated to sustain than an LLC. However, they do still have their own tax advantages and investor opportunities.

When should I use a formal business structure?

There are four general characteristics of businesses that are best suited to a formal business structure.

1. Bigger customer bases.

2. Possibility of sudden and maintainable profit.

3. More risk of liability or loss.

4. Would profit from unique tax advantages.

Why it’s a good idea to form an LLC rather than a corporation:

An LLC is generally the preferable business structure for most small businesses for two reasons:

1. Pass-through taxation

Pass-through taxation gives business owners the opportunity to reinvest profit back into the company without having to pay taxes on the payments. Should you plan to reinvest most of the profit back into the company, the LLC is most beneficial as small businesses tend to forward very little profit from one tax year to the next. The reason for this is that small businesses most often use most of their income on expenses necessary to the function of the business.

Pass-through taxation simply implies that the net income of the business will be reflected on the LLC member’s individual tax returns. As such, the business itself isn’t taxed, but rather the members are taxed on the business’s net income. On the other hand, corporate income is taxed twice, and this isn’t a good idea for small businesses who would like to reinvest their profits in the business in order to stimulate growth.

LLCs also have the added benefit of being able to choose which tax classification they would like to fall under. The Internal Revenue Service (IRS) details these classifications and which would be better suited to your business on their website.

2. Simplest business structure to start and uphold

LLCs don’t require a lot of paperwork, they don’t have a lot of administrative overhead, nor are they very difficult to create. They are very flexible and have the option of becoming corporations later, and this makes them a brilliant place to start growing your business.

If you need some more help to choose the correct business structure for your company then TRUiC offers detailed analyses of the different structures, their advantages and disadvantages, and should you choose an LLC, then a step-by-step guide is provided.